Earning Rewards

The Wells Fargo Visa Signature Credit Card earns 1 point per dollar spent on all purchases. The card’s welcome bonus is structured like this: Earn 5 rewards points per dollar on up to $12,500 spent on gas, grocery, and drugstore purchases for the first 6 months (1 point per dollar thereafter). If you max out this promotion, you’ll earn 62,500 points. These points are valued up to $937.50 if used for airfare or $625 if redeemed for cash.

Unlike other credit cards, there is no upfront welcome bonus after meeting a minimum spending threshold. But considering the potential number of points you can earn during the first six months, that can be viewed as an alternative.

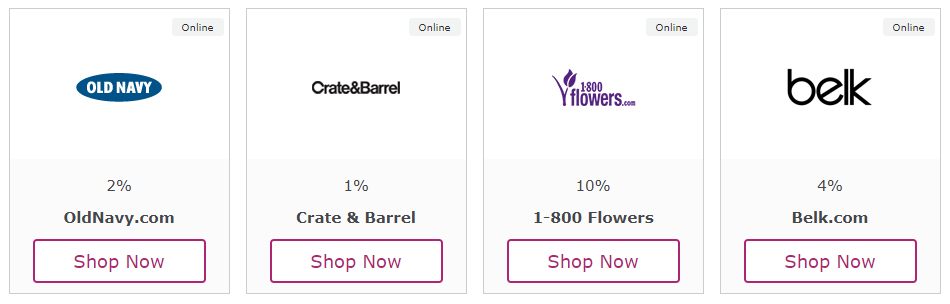

Cardholders can earn additional points through online shopping at the Earn More Mall. At the online shopping portal, you’ll earn points based on a percentage of your shopping total. There are almost 500 participating retailers offering rates from 1% to 10%, including Home Depot, Kohl’s, Apple.com, and 1800Flowers.com.

All points must be used within five years from the date they are earned.

Redeeming Rewards

You can redeem points to book travel on the Wells Fargo travel portal, including flights, hotels, car rentals, and cruises. There are no blackout dates, no advance booking restrictions and no minimum stay requirements. Plus, points can be used for cash back, brand-name merchandise, gift cards, and online auctions.

Points are worth one cent each for most redemptions. However, points are worth 50% more when booking a flight through the Wells Fargo Rewards travel portal. For example, 20,000 points are worth $300 toward airfare, but only $200 toward a hotel reservation or cash back.

Cardholders can pool rewards with other customers for larger redemptions. Points may also be donated to select charities.

Rewards Potential

So that readers can compare rewards from different credit cards, it is essential to understand what kind of rewards you can expect based on your spending patterns.

Forbes Advisor uses data from various government agencies in order to determine both baseline income and spending averages across various categories. The 70th percentile of wage-earning households brings in $100,172 annually and has $52,820 in standard expenses. Of this amount, $9,352 is at gas stations, grocery stores, and drugstores.

With the 5 points per dollar promo available for six months after opening your account, that means the average household spends $4,676 during this time. That would equate to 23,380 points from the initial promotion.

Additionally, you’d earn another 24,000 points if you used the Wells Fargo Visa Signature Credit Card for half of your other expenses. Combined, that would be over 47,000 points, which would be worth $470 in cash back or $705 in airfare.

After the first year, however, this cardholder would earn around 28,000 points per year at a rate of 1 point per dollar for all purchases.